Mumbai, November 11, 2018: Cipla Limited (BSE: 500087, NSE: CIPLA) today announced its unaudited consolidated financial results for quarter ended September 30, 2018.

Key highlights of the quarter

- R&D investments at ~INR 316cr / ~8% of sales

- Continued growth momentum: Growth in private market [non-tender] segments continues strong across India, the US, South Africa and Emerging Markets

- US business sales trajectory improves with 12% YoY growth driven by contribution from new launches. 7 new approvals in the quarter with multiple limited competition assets getting launched

- Quality Focus: Inspection at Goa plant concludes with minor procedural observations

TS:

India1

- As per IQVIA (IMS) Q2’18, Cipla continued its outperformance growing by 14%

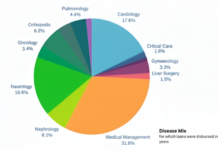

- Performance in key therapeutic areas as follows

- Cipla gained one Rank in Cardiology and now stands at 4th position growing

500bps higher than market at 19%

- Continued leadership position in Respiratory growing at 23%. Cipla’s flagship

inhalation awareness campaign “Berok Zindagi’on a good start

- Urology maintained its leadership position with over 15% market share

SAGA – SOUTH AFRICA, SUB-SAHARAN AFRICA AND GLOBAL ACCESS2

- As per IQVIA (IMS) MAT Aug’18, South Africa business grew at more than double the market at 14% in the private market vs 5% market growth

- As per YTD Aug IQVIA (IMS) data, Cipla became the 3rd largest pharma company in SA private market with 6.3% share

- Closed the Mirren acquisition; working towards successfully integrating the business and driving synergies in fast-growing OTC space

- Successful IPO and listing of Cipla’s subsidiary CiplaQCIL on the Uganda Stock Exchange

NorthNORTHAmerica AMERICA

- DTM [Direct to Market] business saw continued improvement in gross margin through increased contribution from differentiated launches

- 7 approvals in Q2 including Atazanavir, Diclofenac gel and Albendazole

- 5 ANDAs filed during the quarter; on track for 20+ filings in FY19

EUROPE & EMERGING MARKETS

Europe & Emerging Markets

- Biosimilars franchise in the EM: Late stage discussions on-going for various key biosimilar assets across multiple markets

- Signed a commercializing deal for Bevacizumab in Sri Lanka and Nepal.

- Inaugurated Cipla Maroc facility

- FPSM (Fluticasone propionate / Salmeterol) launched in Italy with substitutability status

CONSOLIDATED PROFIT & LOSS STATEMENT

| CONSOLIDATED | Q2FY19 | Q2FY18 | Y-o-Y | Q1FY19 | Q-o-Q | ||||||||||||||||||||||||||

| (IND AS) In INR Cr | Growth | Growth | |||||||||||||||||||||||||||||

| Total Revenue from Operations | 4,012 | 4,082 | -2% | 3,939 | 2% | ||||||||||||||||||||||||||

| EBITDA | 753 | 804 | -6% | 726 | 4% | ||||||||||||||||||||||||||

| % of Income from Operations | 18.8% | 19.7% | 18.4% | ||||||||||||||||||||||||||||

| PAT | 377 | 423 | -11% | 451 | -16% | ||||||||||||||||||||||||||

| % of Income from Operations | 9.4% | 10.4% | 11.5% | ||||||||||||||||||||||||||||

| Financial numbers are rounded off | |||||||||||||||||||||||||||||||

| EBITDA Build-up | |||||||||||||||||||||||||||||||

| INR Cr | Q2FY19 | Q2FY18 | Q1FY19 | ||||||||||||||||||||||||||||

| Profit Before Tax | 509 | 573 | 620 | ||||||||||||||||||||||||||||

| Add: | |||||||||||||||||||||||||||||||

| Finance Costs | 44 | 42 | 35 | ||||||||||||||||||||||||||||

| Depreciation, Amortisation & impairment Expense | 282 | 302 | 241 | ||||||||||||||||||||||||||||

| Less: | |||||||||||||||||||||||||||||||

| Finance, investment & Divestitures related income | 113 | 170 | |||||||||||||||||||||||||||||

| 82 | |||||||||||||||||||||||||||||||

| EBITDA | 753 | 804 | 726 | ||||||||||||||||||||||||||||

| EBITDA % to Sales | 18.8% | 19.7% | 18.4% | ||||||||||||||||||||||||||||

| Financial numbers are rounded off | |||||||||||||||||||||||||||||||

| BUSINESS-WISE SALES PERFORMANCE | |||||||||||||||||||||||||||||||

| Business (In INR Cr.) | Q2FY19 | Q2FY18 | Y-o-Y | Q1FY19 | Q-o-Q | ||||||||||||||||||||||||||

| Growth | Growth | ||||||||||||||||||||||||||||||

| India (Rx + Gx) | 1,644 | 1,645 | 0% | 1,544 | 6% | ||||||||||||||||||||||||||

| North America$ | 758 | 618 | 23% | 670 | 13% | ||||||||||||||||||||||||||

| SAGA# | 754 | 922 | -18% | 835 | -10% | ||||||||||||||||||||||||||

| South Africa^ | 503 | 517 | -3% | 578 | -13% | ||||||||||||||||||||||||||

| Emerging Markets | 472 | 454 | 4% | 469 | 1% | ||||||||||||||||||||||||||

| Europe | 141 | 151 | -7% | 134 | 5% | ||||||||||||||||||||||||||

| API | 171 | 212 | -19% | 200 | -14% | ||||||||||||||||||||||||||

| Others* | 72 | 80 | -10% | 87 | -18% | ||||||||||||||||||||||||||

| Total | 4,012 | 4,082 | -2% | 3,939 | 2% | ||||||||||||||||||||||||||

- Includes South Africa, Sub-Saharan and Cipla Global Access business, excludes SA Animal Health ^ Excluding SA Animal Health

* Includes CNV business, Vet (India and SA Animal Health) and other elements of Revenue

BALANCE SHEET

| Key Balance Sheet Items (In INR Cr.) | Sep-18 | Mar-18 | |||||||

| Equity | 15,091 | 14,582 | |||||||

| Total Debt | 4,653 | 4,098 | |||||||

| Inventory | 4,160 | 4,045 | |||||||

| Cash and Cash Equivalents* | 2,446 | 2,058 | |||||||

| Trade Receivables | 3,971 | 3,102 | |||||||

| Net Tangible Assets | 5,715 | 5,829 | |||||||

| Goodwill & Intangibles | 5,182 | 5,103 | |||||||

| * Includes current investment and excluding unclaimed dividend balances | |||||||||

EARNINGS CONFERENCE CALL

The Company will host an Earnings conference call at 1530 hrs IST (1800 hrs SST/HKT, 1000 hrs BST, 0500 hrs US ET), during which the leadership team will discuss the financial performance and take questions. A transcript of the conference call will be available at www.cipla.com. Kotak Institutional Equities will host the call.

| Earnings Conference Call Dial-in Information | November 5, 2018 at | |

| Date and Time | 1530 | – 1630 hrs IST |

| 1800 | – 1900 hrs SST/HKT | |

| 1000 | – 1100 hrs BST | |

| 0500 | – 0600 hrs US ET | |

| Dial-in Numbers | ||

| Universal Access | Primary Access: (+91 22 6280 1214) | |

| (+91 22 7115 8115) | ||

| Local Access | Available all over India: (+91 7045671221) | |

| Toll-free Number | USA: 1 866 746 2133 | |

| UK: 0 808 101 1573 | ||

| Hong Kong: 800 964 448 | ||

| Singapore: 800 101 2045 | ||

Corporate Comm India(CCI NewsWire)