Continued pressure on US business offsets robust India performance

New Delhi, January 29,2022:

Revenues & profitability:

- Revenue at 2,108 crores up by 6%

- Gross margins: 70%; EBITDA margins: 28%.

- EBITDA at Rs. 585 crores was down by 5%.

- Profit before tax at 357 crores was flat.

- Net profit after tax at 249 crores was down by 16%.

Performance summary:

|

Results |

Q3 FY22 | Q3 FY21 |

YoY% |

||

| Rs cr | % | Rs cr | % | ||

| Revenues | 2,108 | 1,995 | 6% | ||

| Gross profit | 1,470 | 70% | 1,433 | 72% | 3% |

| EBITDA | 585 | 28% | 612 | 31% | -5% |

| PAT | 249 | 12% | 297 | 15% | -16% |

| R&D spend | 123 | 6% | 112 | 6% | 9% |

Commenting on the Q3 results, Samir Mehta, Chairman, said:

“Due to the prolonged delays in reinspection of our US facilities on account of the pandemic, coupled with higher than anticipated pricing pressure, our US business has been adversely affected during this quarter. We remain hopeful of our prospects in the US market as soon as the facilities are reinspected. We have initiated cost optimisation measures which should help us get back on track with respect to margins in the upcoming quarters.

Our India business continues to be on a strong footing delivering significantly higher than market growth during the quarter.”

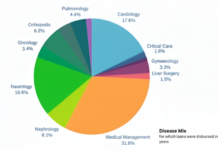

India:

- India revenues at Rs 1,072 crores grew by 15%

- As per secondary market data (AIOCD), Torrent’s Q3 FY22 growth was 15% versus IPM growth of 6%

- MR Productivity for the quarter was Rs 9.9 lakhs with MR strength of 3,600

- Growth was driven by robust performance of top brands in all our focus therapies

Brazil:

- Brazil revenues at Rs 183 crores, were up by 5%

- Constant currency sales at R$ 135 million up by 8%

- Growth was aided by market growth together with performance of top brands and new

- During the quarter, the Company has launched new division in CNS segment.

- Further, Torrent has launched Rivaroxaban molecule [brand name Acog], which has market size of ~R$ 800+ million.

United States:

- US revenues at Rs 235 crores, were down by 20%.

- Constant currency sales were $31

- Sales were lower due to price erosion in the base business and lack of new approvals pending re-inspection of facilities.

- Manufacturing facility at Levittown, USA, was inspected by the USFDA during December 2021 without any observation.

- As on December 31, 2021, 51 ANDAs were pending approval with USFDA and 7 tentative approvals were 2 ANDA was approved during the quarter.

Germany:

- Germany revenues at Rs 237 crores were down by 10%

- Constant currency sales were Euro 28

- Growth was impacted due to muted market growth and increasing competition in Tender segment.

Corporate Comm India (CCI Newswire)