The healthcare industry is developing as people spend heavily on building healthcare infrastructure. The pharmaceutical industry is also experiencing robust growth owing to the growing prevalence of chronic and communicable diseases. The Active Pharmaceutical Ingredients (API) market plays a critical role in the global pharmaceutical industry, serving as the foundation for developing and producing various drugs. APIs are the key components responsible for the therapeutic effects of pharmaceutical products, making them a vital aspect of healthcare worldwide.

What are Active Pharmaceutical Ingredients?

Active Pharmaceutical ingredients refer to the biologically active components in pharmaceutical drugs that produce the desired therapeutic effect. They are the critical chemical substances responsible for the pharmacological activity of the medication. APIs can be of synthetic origin or derived from natural sources, such as plants, animals, or microorganisms.

APIs are typically formulated with other inactive ingredients to create finished dosage forms, such as tablets, capsules, or injections. These additional ingredients are known as excipients and help deliver the API to the body, provide stability, and enhance drug absorption.

APIs undergo extensive research and development, including preclinical and clinical trials, to establish their safety and efficacy. Regulatory authorities, such as the Food and Drug Administration (FDA) in the United States or the European Medicines Agency (EMA) in Europe, require rigorous testing and documentation before an API can be approved for use in pharmaceutical products.

Market Overview

The Active Pharmaceutical Ingredients market is anticipated to grow significantly. The growth of the market is attributed to the growing prevalence of chronic cardiovascular disease and cancer. Increasing penetration towards quality standards in API manufacturing. The government is also taking various initiatives in order to propel API production. The government of various countries has implemented plans to promote the production of API.

The growing geriatric population, along with a weaker immune system, is anticipated to drive the growth of the market. The government is also investing heavily in healthcare infrastructure owing to the growing need for affordable and effective pharmaceuticals. Growing advancement in pharmaceutical manufacturing technologies is driving the development of the industry.

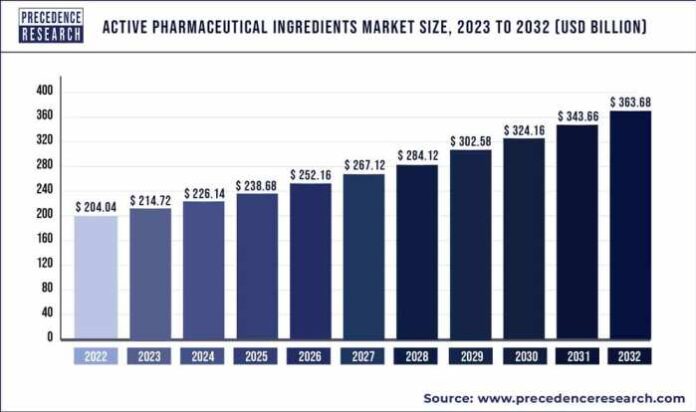

According to Precedence Research, the global active pharmaceutical ingredients market size was valued at USD 204.04 billion in 2022, and it is expected to be worth around USD 363.68 billion by 2032 and expanding at a CAGR of 6.1% over the forecast period 2023 to 2032. The U.S. active pharmaceutical ingredients market was valued at USD 34.90 billion in 2022.

SWOT analysis

Strengths:

Growing demand: The API market has witnessed significant growth due to the increasing demand for generic drugs and biologics, especially in emerging economies.

Essential for drug manufacturing: APIs are the primary raw materials used in the production of pharmaceutical drugs, making them a crucial component of the healthcare industry.

Technological advancements: Advances in manufacturing processes, such as continuous manufacturing and the use of novel technologies like nanotechnology, have improved the efficiency and quality of API production.

Intense research and development: The API market benefits from ongoing research and development activities, leading to the discovery of new APIs, improved formulations, and therapeutic advancements.

Weaknesses:

Complex regulatory environment: The API market is subject to stringent regulatory requirements, including quality standards, safety regulations, and compliance with good manufacturing practices (GMP), which can pose challenges for manufacturers.

Dependency on external suppliers: Many pharmaceutical companies rely on external suppliers for APIs, making them vulnerable to supply chain disruptions, quality issues, and pricing fluctuations.

Pricing pressures: The API market is highly competitive, leading to pricing pressures for manufacturers. This can impact profitability, particularly for generic APIs with multiple suppliers.

Intellectual property issues: Manufacturers may face intellectual property challenges, such as patent expirations or patent infringement claims, which can impact the market share and profitability of API producers.

Opportunities:

Increasing generic drug usage: The rising demand for affordable medicines and the expiration of patents for several blockbuster drugs create opportunities for generic API manufacturers.

Biologics and personalized medicine: The growing adoption of biologics and customized medicine presents opportunities for API manufacturers to develop specialized APIs for these therapies.

Emerging markets: Rapidly growing pharmaceutical markets in emerging economies, such as China, India, and Brazil, offer significant growth potential for API manufacturers.

Contract manufacturing and outsourcing: Increasing outsourcing of API production by pharmaceutical companies provides opportunities for contract manufacturing organizations (CMOs) and API manufacturers to expand their customer base.

Threats:

Intense competition: The API market is highly competitive, with a large number of manufacturers vying for market share. This can lead to price wars and margin erosion.

Counterfeit and substandard APIs: The prevalence of counterfeit and substandard APIs in certain regions poses a threat to patient safety and the reputation of legitimate API manufacturers.

Regulatory challenges: Changes in regulatory requirements, such as stricter quality standards or more complex approval processes, can increase compliance costs and affect market access for API manufacturers.

Supply chain disruptions: Any disruptions in the global supply chain, such as natural disasters, trade conflicts, or pandemics, can impact the availability and cost of APIs, affecting the overall market stability.

Regional Analysis

Based on region, the market is segmented into Latin America, North America, the Middle East, Africa, Europe, and Asia Pacific. North America acquired the dominant share in the overall market and is expected to account for significant growth during the upcoming years. The development of the region is attributed to the surging aging population and increasing incidence of disease.

The increasing spread of the pandemic has propelled the demand for pharmaceutical drugs. The Asia Pacific region is also anticipated to grow significantly during the upcoming years on account of cooperation in the industry for setting up API business plants. Increasing expenditure on the development of healthcare infrastructure is anticipated to boost market growth.

COVID-19 Impact

Due to the outburst of the coronavirus pandemic, the pharmaceutical industry has suffered supply chain disruption. The government imposed stringent regulations and nationwide lockdowns to curb the spread of the disease. However, the spread of the virus overall had a positive impact on the growth of the market. The major players in the market are manufacturing high amounts of ingredients in order to meet the demand for COVID-19 treatment.

Regulatory authorities in different countries implemented various measures to address the challenges faced during the pandemic. Some countries introduced expedited approval processes for APIs and drugs related to COVID-19 treatment. Regulatory flexibility and guideline changes were implemented to facilitate the development, production, and availability of essential APIs.

Corporate Comm India (CCI Newswire)